Transaction Advisory Services Things To Know Before You Get This

Transaction Advisory Services Things To Know Before You Buy

Table of ContentsGetting The Transaction Advisory Services To WorkSome Known Questions About Transaction Advisory Services.The Definitive Guide for Transaction Advisory Services7 Simple Techniques For Transaction Advisory ServicesNot known Details About Transaction Advisory Services

This step sees to it the organization looks its ideal to possible purchasers. Obtaining business's worth right is critical for an effective sale. Advisors use various techniques, like discounted cash circulation (DCF) analysis, contrasting with comparable firms, and current transactions, to figure out the fair market price. This aids set a fair cost and negotiate properly with future purchasers.Transaction experts action in to aid by obtaining all the needed information arranged, responding to concerns from purchasers, and organizing brows through to the business's location. Purchase consultants use their expertise to aid company proprietors take care of tough negotiations, satisfy customer assumptions, and framework deals that match the proprietor's goals.

Meeting legal rules is essential in any business sale. Transaction advising services collaborate with lawful professionals to produce and examine contracts, contracts, and other legal documents. This lowers risks and makes certain the sale adheres to the legislation. The duty of purchase advisors extends past the sale. They help company owner in preparing for their next actions, whether it's retirement, starting a brand-new endeavor, or handling their newly found wide range.

Deal experts bring a wide range of experience and understanding, ensuring that every element of the sale is handled properly. Via critical preparation, valuation, and settlement, TAS assists company owner attain the greatest possible price. By making certain legal and regulatory conformity and handling due persistance along with various other deal group members, purchase consultants minimize potential threats and obligations.

What Does Transaction Advisory Services Mean?

By contrast, Big 4 TS teams: Work with (e.g., when a potential purchaser is conducting due persistance, or when an offer is shutting and the purchaser requires to incorporate the firm and re-value the seller's Balance Sheet). Are with fees that are not linked to the deal shutting successfully. Gain charges per interaction somewhere in the, which is less than what financial investment financial institutions gain also on "tiny offers" (yet the collection likelihood is also much greater).

The interview inquiries are really comparable to investment banking meeting inquiries, but they'll concentrate more on accounting and valuation and much less on topics like LBO modeling. Anticipate questions concerning what the Modification in Working Capital means, EBIT vs. EBITDA vs. Earnings, and "accountant just" subjects like test equilibriums and just how to go through events utilizing debits and credits instead of economic declaration changes.

Facts About Transaction Advisory Services Revealed

Professionals in the TS/ FDD groups might also interview management regarding whatever over, and they'll write a detailed report with their findings at the browse this site end of the process.

, and the general shape looks like this: The entry-level duty, where you do a lot of data and economic evaluation (2 years for a promo from here). The next degree up; comparable work, yet you get the even more fascinating little bits (3 years for a promotion).

Particularly, it's challenging to get promoted past the Supervisor level due to the fact that couple of people leave the job at that stage, and you need to start showing proof of your capability to produce revenue to breakthrough. Let's start with the hours and way of living considering that those are less complicated to explain:. There are occasional late evenings and weekend job, but nothing like the frenzied nature of financial investment financial.

There are cost-of-living adjustments, so expect lower payment if you're in a more affordable location outside significant economic (Transaction Advisory Services). For all placements except Partner, the base wage comprises the bulk of the overall settlement; the year-end bonus offer may be a max of 30% of your base pay. Frequently, the most effective method to raise your profits is to switch over to a different company and negotiate for a higher wage and benefit

The Facts About Transaction Advisory Services Uncovered

At this stage, you must simply stay and make a run for a Partner-level duty. If you desire to leave, maybe relocate to a client and do their valuations and due persistance in-house.

The major trouble is that due to the fact that: You generally require to sign up with another Big 4 group, such as audit, and job there for a few years and afterwards relocate into TS, work there for a few years and after that move into IB. And there's still no guarantee of winning this IB function due to the fact that it relies on your region, clients, and the hiring market at the time.

Longer-term, there is likewise some danger of and because reviewing a company's historical monetary information is not specifically brain surgery. Yes, humans will always need to be involved, yet find out here with even more innovative modern technology, lower head counts can possibly support customer involvements. That said, the Purchase Services group beats audit in terms of pay, work, and exit chances.

If you liked this short article, you might be thinking about reading.

The Basic Principles Of Transaction Advisory Services

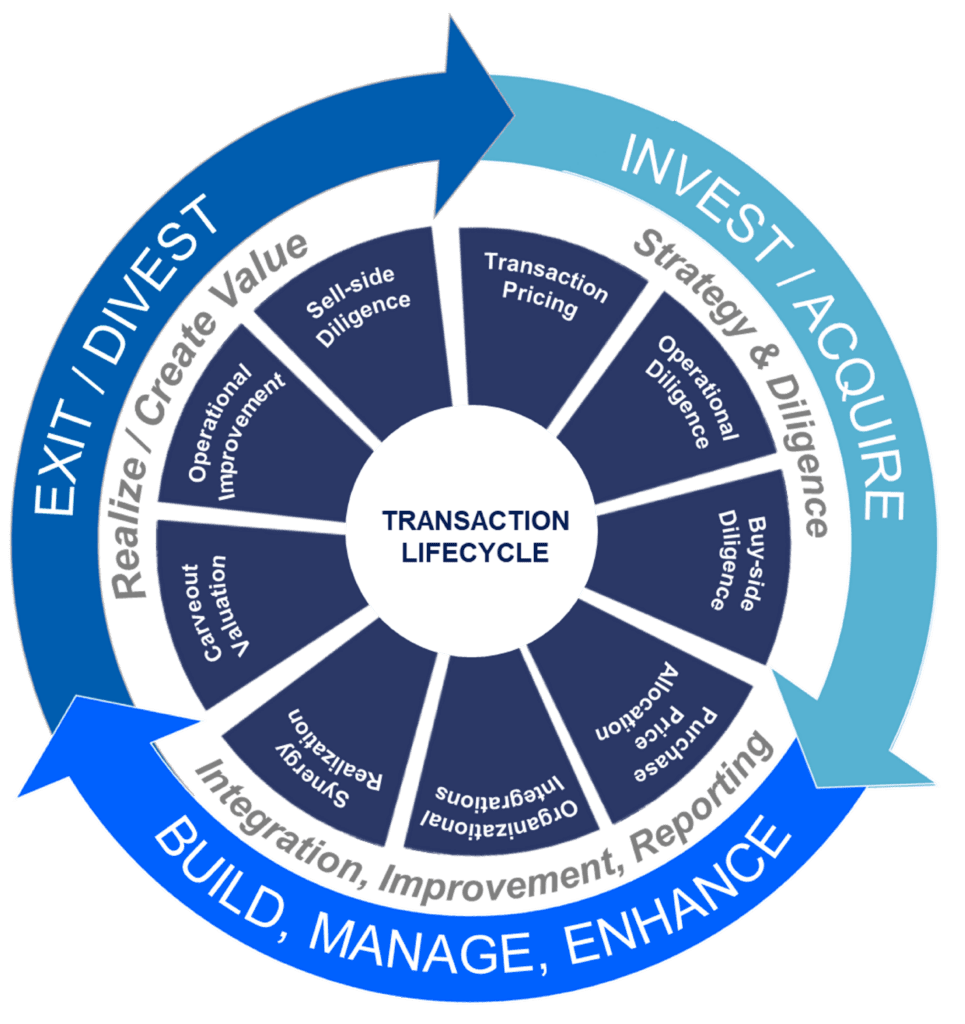

Develop innovative economic frameworks that assist in determining the real market worth of a firm. Give advising work in connection to organization evaluation to help in negotiating and prices structures. Clarify the most look at this now appropriate form of the deal and the kind of consideration to use (money, supply, gain out, and others).

Create activity strategies for threat and direct exposure that have been determined. Execute assimilation preparation to establish the procedure, system, and organizational adjustments that might be called for after the offer. Make mathematical price quotes of integration costs and benefits to analyze the economic reasoning of integration. Establish guidelines for integrating divisions, innovations, and business processes.

Examine the prospective customer base, market verticals, and sales cycle. The functional due diligence supplies vital understandings right into the performance of the company to be acquired concerning risk evaluation and value production.